Little Green Light is a cloud-based donor management system for fundraisers.

Subscribe to get our latest product updates, best practices and tips to grow your nonprofit.

6 Steps to a Successful Appeal : Part five of a six-part series

Good practices in gift acknowledgment and accounting have a beneficial effect on your donor relationships. To ensure that donors understand the value and your appreciation of their gift to your organization, it’s important to have a gift acknowledgment process in place that’s pertinent, personal, and prompt. Pertinent, meaning that your thank you matches the intention of the gift. If a donor is giving to a scholarship fund, don’t send a thank you for their contribution to your capital campaign.

By properly tracking gift information, such as campaigns, funds, appeals, or gift categories, you can ensure that donations are received and credited to the intended purpose. If a donor asks that their gift be made in memory of a beloved relative, and we neglect to acknowledge and report on that appropriately, we risk losing that donor. In the same vein, if a donor makes a request to restrict their gift to a specific purpose, it’s crucial we clearly identify that, both in our database systems and in our recognition of the gift. Two of the biggest mistakes a development office can make is to not utilize a donor’s gift as it was intended and not thank the donor for their generosity.

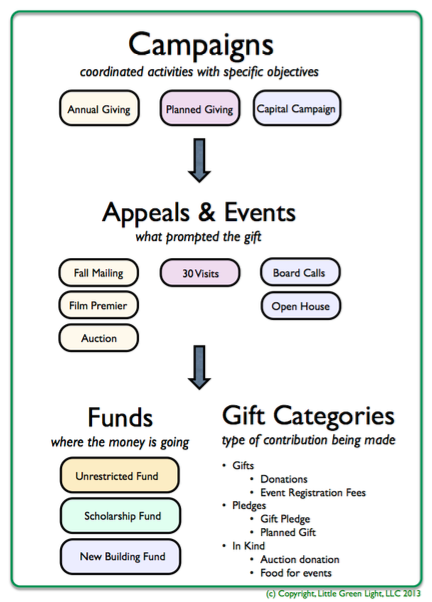

Campaigns, Appeals, and Funds

Figure 16. Campaigns, Appeals/Events, Funds, and Gift Category each provide a specific type of information to fundraisers.

There are many ways to share with your donor base how important they are to your organization and its growth. Acknowledging gifts can continue throughout the year in the form of everything from a phone call to a holiday card, a student thank you letter, or an invitation to a formal recognition event. The president of your organization or school or your fund leadership chair can even make a direct call to the donor on the same day you receive a gift over a certain amount, for example.

Having a streamlined and consistent way to track gifts and generate acknowledgements is a necessary component of a successful annual giving campaign. Utilizing a donor database system that allows you to track all your constituents, gifts, and fundraising activities as well as manage acknowledgments will allow you to be more effective and efficient in your efforts. Keeping track of gifts in a binder or ledger will become a cumbersome and unyielding task when you are attempting to manage multiple constituents with multiple years of giving. It’s likely that not all gifts will be acknowledged promptly.

To ensure a prompt acknowledgment, ideally within 48 hours of receipt, you can put a simple system in place in LGL to generate acknowledgment letters from templates. You can also track your gifts and acknowledgments and put in related tasks for follow up. A good stewardship activity is to add a follow-up task for large gifts, such as asking your organization head to place a personal call to thank the donor on the day the gift is received. Having the ability to communicate information quickly to your organization’s team members, being able to see if a follow-up call was made, and documenting a contact report about interactions are all benefits of using LGL’s CRM capabilities.

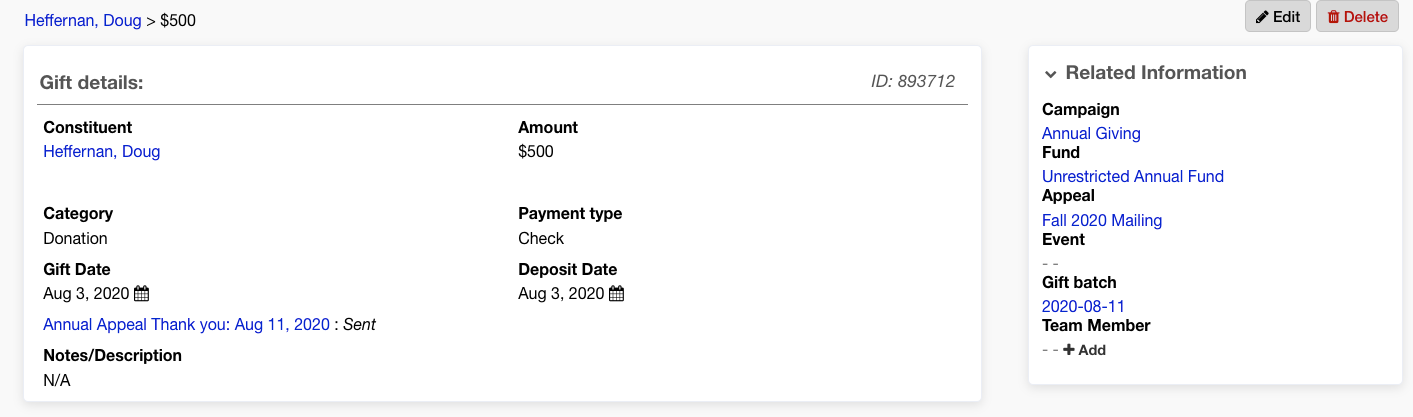

Figure 17. Gift Information screen in LGL

Using the LGL Gift Information screen in Figure 17 as an illustration, see how a donor management system can help you manage gift information and track the donor, gift amount, and date, payment method, and donation purpose. You can also manage acknowledgments, special gift types such as in memory of, or in honor of type gifts.

End part five

Ready to try LGL? Get your first 30 days free. No credit card required.