Little Green Light is a cloud-based donor management system for fundraisers.

Subscribe to get our latest product updates, best practices and tips to grow your nonprofit.

Every January, we are inundated by customer questions about how to configure mailings and emails as year-end tax statements. So we decided to create a special area in Little Green Light just for this purpose. Introducing … Annual Gift Statements!

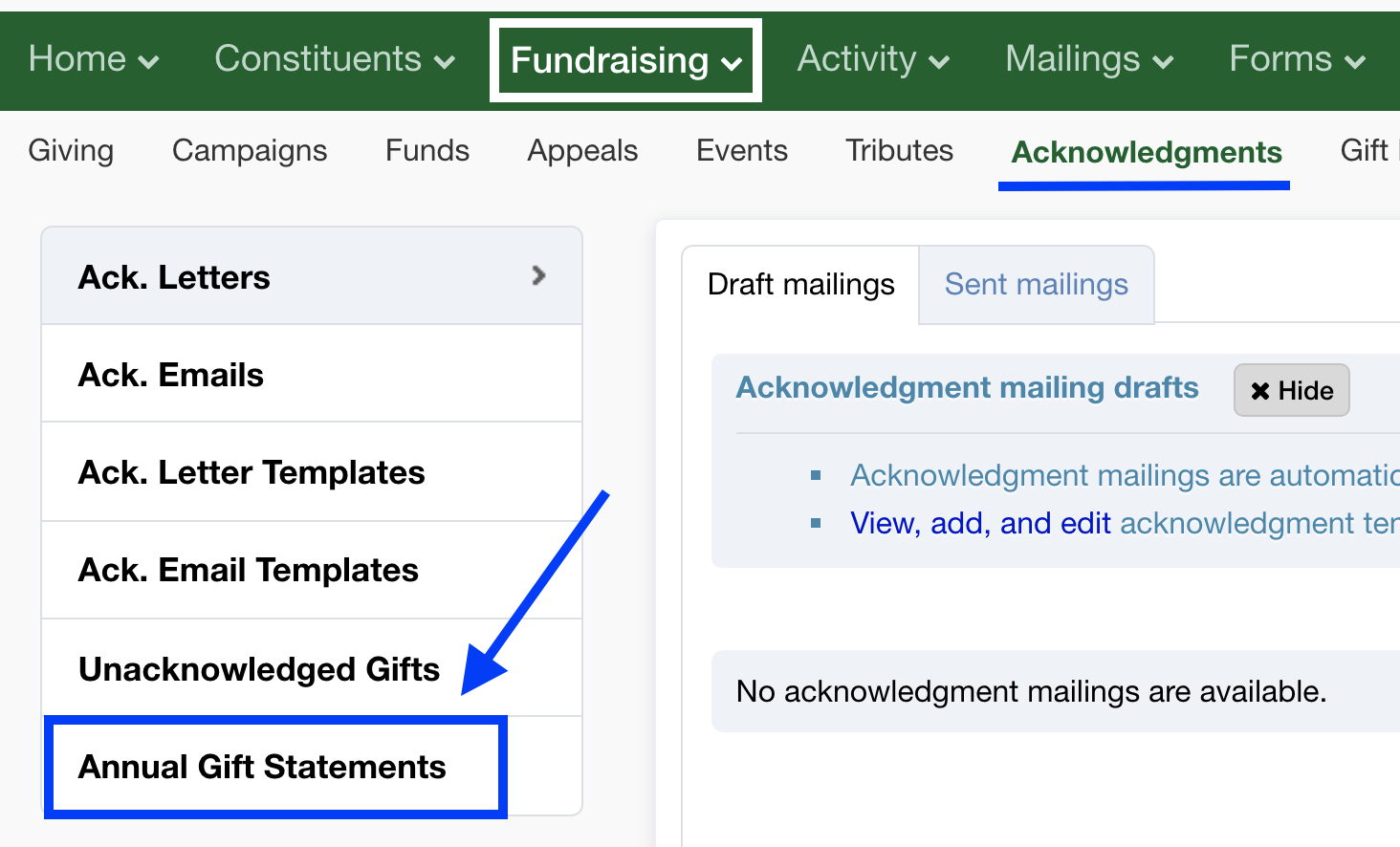

This new feature will be ready for you when you get back to work in January; it should be in your LGL account by January 4, 2022. You’ll see the link to it in Fundraising > Acknowledgments, in the navigation menu on the left side of the page.

The old method of using LGL general mailings or emails to create your year-end letters and emails remains available and completely viable. But, if you’re looking for a quicker, easier solution, the new method can help.

This article provides a high-level overview of the new Annual Gift Statements feature and includes a registration link for the related training webinar that we’re offering on Thursday, January 6.

As with any mailing or email, Annual Gift Statements combine two key elements:

1. Your recipient list, and

2. The letter/email you are sending or emailing

Here’s how they work together.

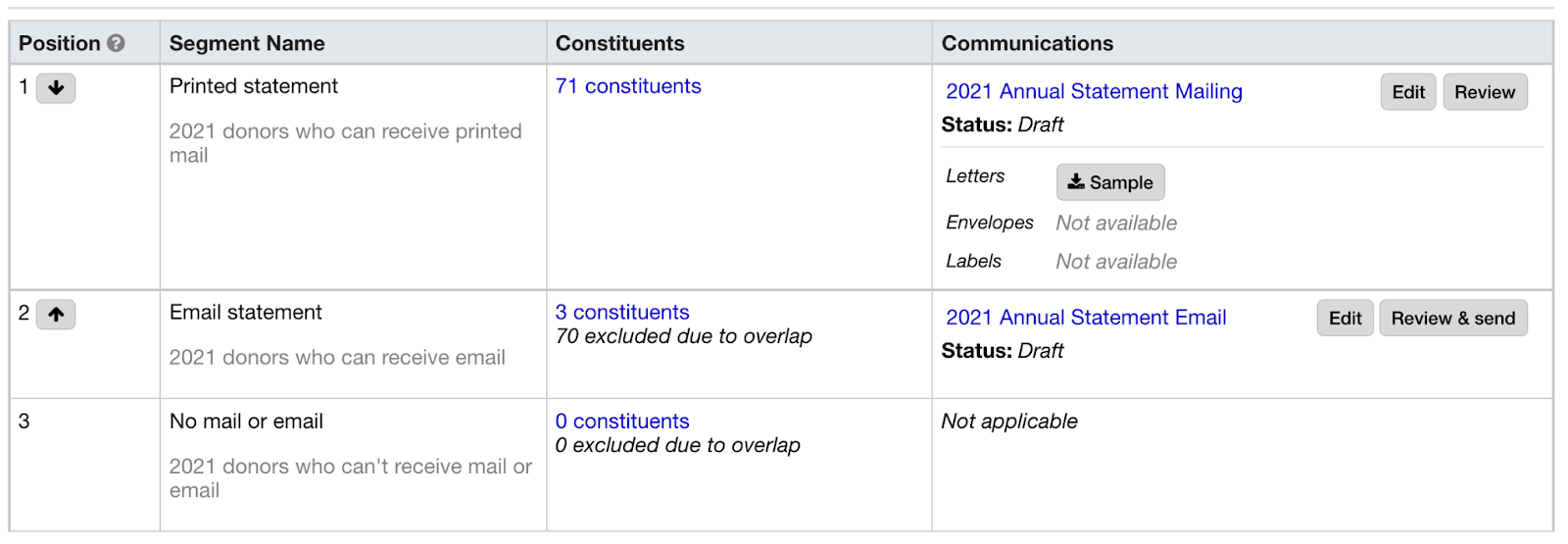

LGL automatically selects all of your donors for the recipient list. Here, “donor” includes anyone who gave your organization a “gift” (with a gift type of “Gift”) for the year 2021.

But not every donor can receive mail or email from you (for example, if they are on your “do not mail” list or if they don’t have an email address). For this reason, LGL segments these donors into two groups: (1) those who can receive mail and (2) those who cannot receive mail but can receive email (there’s also a third segment that can receive neither).

In terms of the two available “segments,” you can choose to prioritize email over mail or mail over email (the latter option is set by default).

Your Annual Tax Statements contain, by default, sample year-end tax language for your letter or email. We expect that you will customize this text before sending.

The letter/email also includes a gift table, which itemizes the gifts received. There’s a special area for customizing the gift table. For example, you can choose whether to include in-kind gifts sent by your donors, and you can choose to include descriptive fields such as campaign, fund, and appeal.

You’ll see both of these elements (the recipient list and the letters/emails) as soon as you activate the Annual Gift Statements for 2021.

For a full description of the Annual Gift Statements feature and how to use it, please visit our Knowledge Base and click on the article, titled “Quickly generate a simple annual tax statement in your account”.

Comments are closed.

Comments are closed.

Ready to try LGL? Get your first 30 days free. No credit card required.

Will the Webinar on the new tax statement feature be available online? We can’t make the one showing.

Yes! All our training webinars get posted in the Training videos area of our Video Library which can be accessed here: https://help.littlegreenlight.com/category/487-training-videos