Little Green Light is a cloud-based donor management system for fundraisers.

Subscribe to get our latest product updates, best practices and tips to grow your nonprofit.

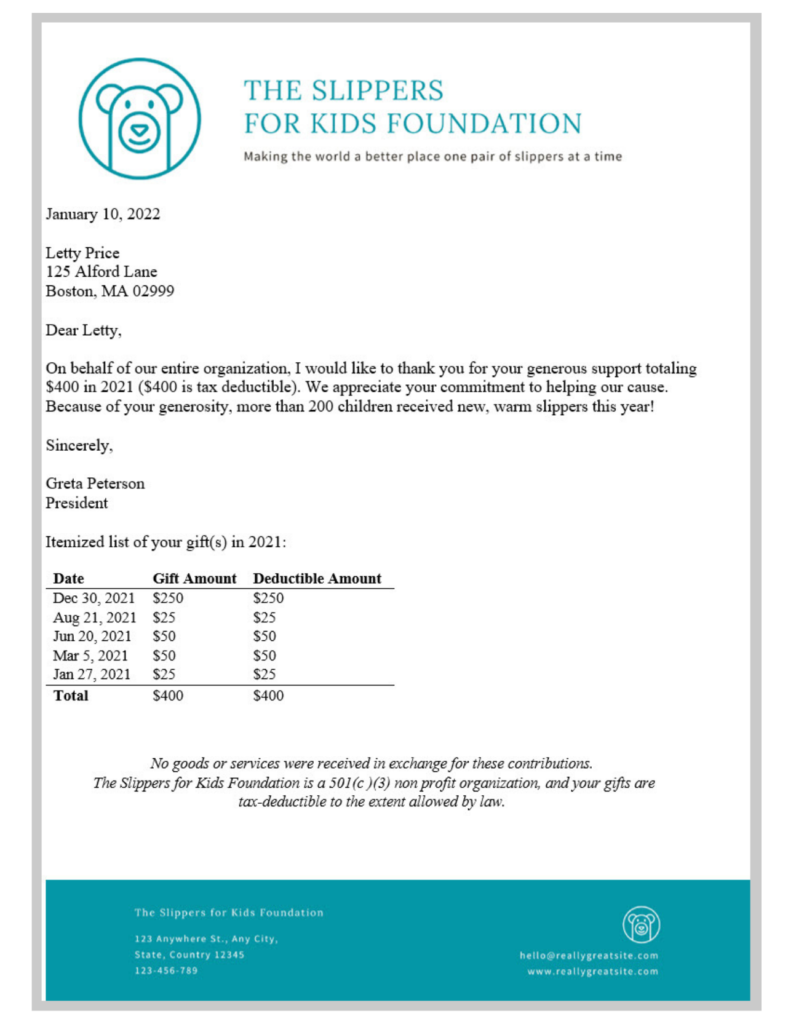

When you send annual gift statements to donors, you provide them with a convenient summary of their charitable contributions. These statements are more than just a helpful document for donors as they complete their taxes, though. They also give your organization an additional opportunity to express gratitude for your donors’ charitable giving.

If you acknowledge gifts as they are received throughout the year, then it’s not required to send annual gift statements at the year’s end. Your organization has already fulfilled its IRS obligation to provide documentation for charitable gifts of $250 or more.

But, even if you’ve already acknowledged gifts, sending annual gift statements can help reinforce relationships with donors and build their trust in your organization.

The look of your annual gift statements should be in keeping with the other communications you send throughout the year. Include contact information in case your donors have questions. Remember to proofread your template carefully. Typos or spelling errors look unprofessional and may lead your donors to question the accuracy of your records.

Your organization may have a fiscal year start date of July 1, but remember that, for tax purposes, your donors need information for the gifts they’ve made during the calendar year.

In your letter, include the date and amount for financial contributions. List the donor’s total giving amount for the year, too.

If you’re a Little Green Light customer looking for specific instructions on how to create annual gift statements like the one pictured above, we’ve introduced new functionality to help simplify the process for you. Learn how you can quickly generate an annual gift statement in your LGL account.

If your organization takes a more customized approach to your statements, check out these resources in our Knowledge Base. They include step-by-step instructions for creating a more customized mailing, a recorded webinar, and tips specifically for our Canadian customers.

Ready to try LGL? Get your first 30 days free. No credit card required.