Little Green Light is a cloud-based donor management system for fundraisers.

Subscribe to get our latest product updates, best practices and tips to grow your nonprofit.

We are often asked about the best way to deal with the difficult task of tracking gifts that people commit to make sometime in the future, especially when dealing with monthly donations. The question is, should we use the pledge functionality all the time?

Like so many things, the answer is, “it depends.” To help you think about how and when to use the pledge functionality, we’ve put together the following recommendations.

Limit pledge entry to commitments that are for a specific dollar amount over a clearly defined period of time and that you, as an organization, believe are highly likely to be fulfilled. If you know or believe that another legal entity will fulfill any part of the commitment (donor’s company, family trust, etc.), it is best not to enter the full pledge under the donor’s name, but rather to seek clarity about the commitments from the other entities.

So it is best to enter a pledge for which:

a) There is a written commitment,

b) There is a verbal commitment from someone like a board member or other seriously loyal supporter, and,

c) Where there is some indication of commitment combined with evidence of a habit of fulfilling that commitment (e.g., a person who makes monthly donations and has a good history with those).

We recommend that if you don’t, or can’t, get a specific dollar commitment in writing from monthly donors and want to use the pledge functionality of LGL, you should not have that pledge extend beyond the current fiscal year. So if a donor commits to monthly gifts in September and the fiscal year ends in June, you would enter a pledge that ended in June. This promotes communication regarding renewal of the monthly commitments as part of your fiscal planning cycle.

We strongly suggest that you develop a clear organizational rationale for what qualifies as a pledge in terms of when the organization can count on the funds arriving in the future and a consistent practice of when you want to use the pledge functionality of LGL (may have different criteria than what the organization wants to treat as a pledge). There are several potential downsides to using the pledge functionality of LGL without having a clear set of organizational guidelines:

Most donors we are aware of put a great deal of thought into making that commitment, and we think you will be well served to put a lot of thought and planning into how you will treat them in LGL. Pledges are important to fundraising; represent a powerful feature set in LGL; and are easy to enter, report on, and set up reminders for pledge installments.

You can find instructions for entering a pledge in our Knowledge Base, but the fundamentals involve filling out which constituent actually made the pledge, how much the pledge is for in total, when the first installment will be paid, what the interval between installments is, and how much that first installment will be. Your documentation from the donor should contain all the information you need to set up the pledge and the installments. You can set up soft credits in relation to pledges, so this would allow you to enter a pledge for a company or family foundation and soft credit your individual donor who will make that gift possible.

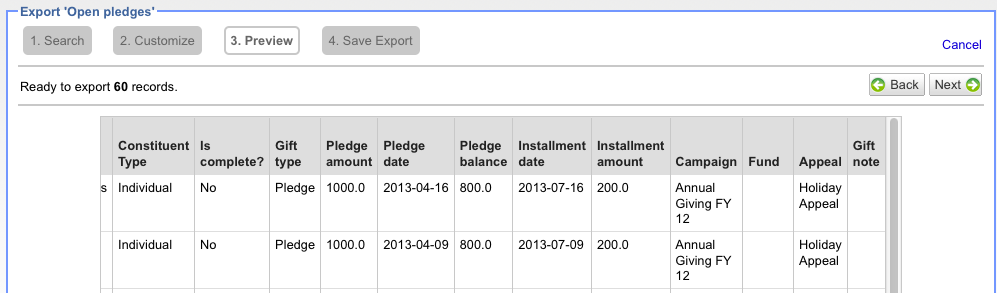

Reporting on pledges, payments made, and installments due during any period of time is easy and can be automated.

So it is easy to tell LGL to remind you of upcoming installments and generate automated and customizable spreadsheet-friendly exports. This functionality lets you keep on top of upcoming installments your donors intended to make, and you can generate mail-merged physical letters or emails to send friendly installment reminders when appropriate.

We highly recommend using LGL’s pledge functionality, but we caution against letting the technical ease of entering a pledge get too far away from any formal records you have confirming those pledges.

Ready to try LGL? Get your first 30 days free. No credit card required.