Little Green Light is a cloud-based donor management system for fundraisers.

Subscribe to get our latest product updates, best practices and tips to grow your nonprofit.

Sponsorships might be an important funding source for your nonprofit organization. As you prepare to solicit sponsorships, set some time aside to prepare an acknowledgment template specifically for your sponsors. Sponsorships are different from a typical charitable gift, so there are some key elements to keep in mind.

Sponsorships are generally not tax-deductible because the donor is receiving something in exchange for their sponsorship. Often, they are receiving signage at an event, a logo displayed on your website, etc. Your organization’s acknowledgment letter to sponsors should not state that their gift is tax-deductible unless that is the case.

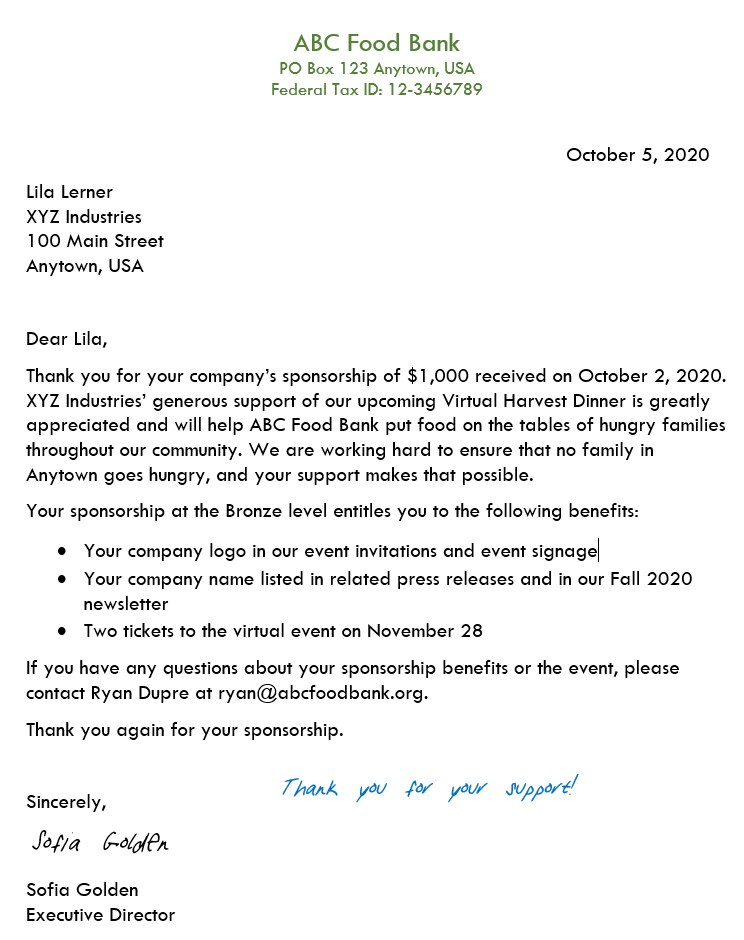

Even though a sponsorship is not a tax-deductible contribution, it’s still appropriate and important for you to set a tone of appreciation in the letter. Make sure the sponsor knows how much your organization values their support and how, specifically, it will further your organization in its mission. If possible, add a brief handwritten note to emphasize your appreciation.

Use the acknowledgment letter as an opportunity to confirm the sponsorship level and what that entails. For example, you can thank the company for being a Bronze sponsor and list the specific benefits of that sponsorship level.

In case the company needs to ask questions or clarify details of their sponsorship benefits, make it easy for them by telling them exactly who to contact and how they should do so. You may have provided that information when you solicited a sponsorship, but it’s a good idea to provide it again.

Here’s an example that you can use as a starting point as you create your own sponsorship acknowledgment template:

The language in a sponsorship letter differs from the language used for a charitable contribution. But, the goal is the same: To express appreciation and provide accurate details of the financial support. Creating an acknowledgment template specifically for sponsors will help your organization manage and cultivate these important supporters.

Using a donor management system like Little Green Light makes creating personalized acknowledgments through the use of templates a breeze. Learn more about how Little Green Light can help you manage your nonprofit’s fundraising efforts by joining a free demo.

Comments are closed.

Comments are closed.

Ready to try LGL? Get your first 30 days free. No credit card required.

Hey, Checkout this blog for knowing Difference between Donation and Sponsorship https://whydonate.nl/en/blog/donation-vs-sponsorship/

Wouldn’t a portion of the sponsorship gift be deductible? It seems like the tangible value of any benefits could be stated and/or the amount less tangible benefits could be stated as deductible.

Hi Jessica,

That could certainly be the case depending upon your sponsorship amounts and benefits. If a portion is tax-deductible, then you would acknowledge that as you mentioned. Thanks!